Accelerate - Q2 2025 - Call Vault

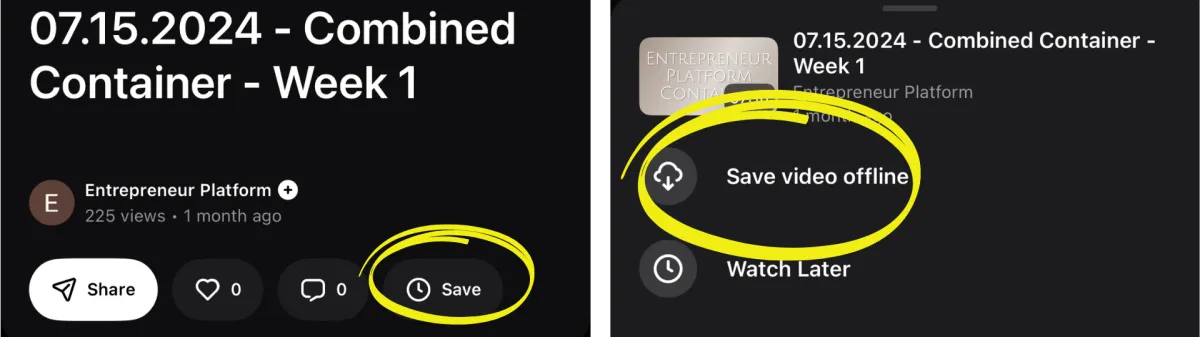

Please Note: If you would like to watch these videos offline:

First download the Vimeo app on your phone.

Open each video's Vimeo link in the Vimeo app.

Click "Save" and then "Save video offline" to save it to the app for offline viewing later.

Round 4 - Q2 2025

Week 1 -Financial literacy & money mindset w/ marina & natacha

From Marina & Natacha:

Hey guys!!! We loved this call thank you for attending and participating! We hope it was really valuable for you.

Your homework for our next call in 3 weeks:

1 – Reflect on your money story/situation.

What did you hear growing up about money?

How was money handled? Did you talk about money? Were your parents savers or spenders?

How have you been feeling about money?

Do you avoid looking at your finances? Do you feel overwhelmed by it? Does it make you nervous?

What have your money habits been? Do you spend, save, etc.?

Do you have debts? If so, how much?

How does it make you feel?

And finally, what would you like to create or become in regard to money? Would you like to feel secure with your finances, become a good money manager, make your money work for you, develop good money habits, control your spending, save more, etc.?

Write anything that comes up. There's no right or wrong—it will only help you heal your money story and change it.

Reflect on your values. Is money, saving, or business in your top 3 values? If not, reflect on these questions and start a list:

How is making money a benefit and service to the things I value most in my life?

How is building a business that serves ever-greater numbers of people a benefit and service to the things I value most in my life?

If you’re not sure what your top values are, we invite you to do the Demartini test:

👉 https://drdemartini.com/values/

2 – Open a new account (or use one you already have) and a new credit card

Make sure all your business expenses are charged to that account or credit card.

3 – Look at your money situation.

If you have debts, make a list of them all.

Also make a list of your assets—you might be surprised by what you see.

Don’t worry or stress about what you’re seeing. The first step is becoming aware of our situation so we can change it.

Next call, we’ll help you create a plan.

4 – Create a money system and start tracking your money.

You might use an app to track your spending and enter your income, or you might do it on a Google Sheet—or a combination of both.

For example, Marina only uses a Google Sheet, and Natacha uses a combination of both.

I—Natacha—use EveryDollar to track my daily spending (groceries, Costco, restaurants, gas, etc.). I also track some of my business expenses in EveryDollar.

Once a week, usually on Sunday or Monday, I look at all our credit cards and accounts and track our expenses to make sure everything has been accounted for—either in EveryDollar or my Google Sheet. Every penny that comes in and out needs to be tracked!

If you’re in the US, you can link your bank account to EveryDollar—but not if you’re in Canada.

Here’s my Google Sheet that you can use and adjust to your brain. All the formulas are already created:

I had to go over it quickly during the call, so I made a video to explain the tracker—I think it’ll make more sense when you watch it. I’m also giving advice to Canadians who own their funnel regarding US income & expenses:

Week 4 -Financial literacy & money mindset w/ marina & natacha pt 2

HOMEWORK

- Complete the homework from week 1

- Track your income & expenses & improve your system for this

- Find your freedom number as we discussed today - what is 6 months of expenses & paying yourself??

- Dive into financial literacy resources to continue your learning and make this a habit👇

Podcast episode from Dr. DeMartini about investing:

https://podcasts.apple.com/us/podcast/the-demartini-show/id1444530306?i=1000704850011

Books:

Smart women finish rich by David Bach. - my favorite book

Smart couple finish rich by David Bach

The wealthy barber returns - really good to get you started into financial literacy, a fun read and your learning at the same time.

Week 5 -Lead Generation w/ SAMARA

Week 7 -Financial literacy wrap up with natacha & marina

Copyright © 2024 | Entrepreneur Platform LLC. | All rights reserved.

Privacy Policy | Terms Of Use | Contact Us